To Cloud, or, not to Cloud, that is not the question. When it comes to transitioning brick and mortar services to a virtual platform, adopting Cloud technology is no longer a binary choice. Cloud technologies have enabled credit unions to continue to serve members and support staff remotely. The Cloud has allowed credit unions to reach new memberships by using a technology that is both affordable and secure. Now, adopting Cloud technologies is a critical strategic step in the credit union digital journey. But the question remains, how exactly do we build our credit union in the Cloud?

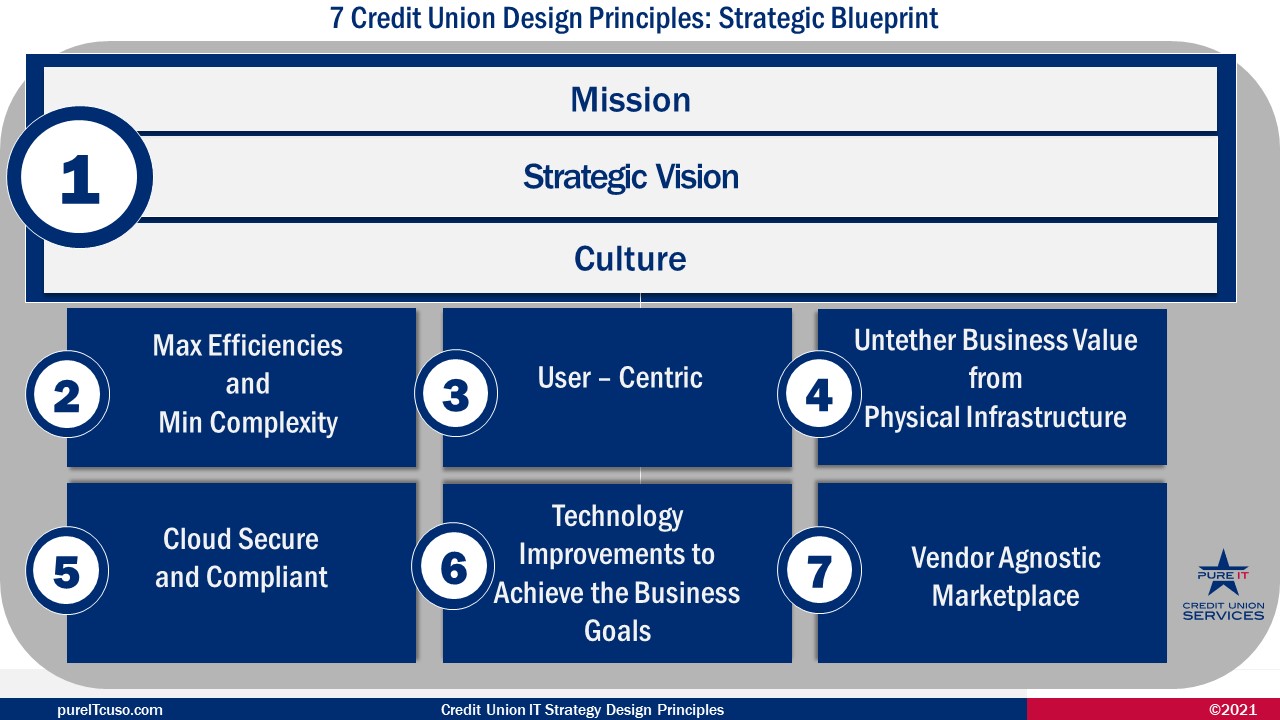

Behold best practices, the Credit Union Cloud Design Principles. When applied together, they create a roadmap and navigation tool that benchmarks credit union technology choices. These principles position technology as the common denominator throughout the entire credit union, reaching business goals. A combination of technology and common sense, this blueprint applies to credit unions across the board – regardless of size, location, or maturity. How they are implemented, and at what time, depends on specific credit union information. What is key here are two basic strategic elements: know where your credit union currently stands and understand where you want to go. These principles will show you how to get there.

This method frames technology into your business plan, creating a scaffolding to support future technology decisions. From major overhauls to daily improvements, the Design Principles guide business strategy in a manner where efficiencies and cost savings are maximized.

- Mission, Strategic Vision and Culture. This first principle builds a solid and crucial foundation. Your vision statement, mission, and culture are unique to your credit union. They give your credit union identity, create marketplace differentiation, and become core pillars that anchor all organizational activities. Every strategic move should boil down to these themes.

The remaining principles have no order and no hierarchy. They do, however, depend on the specifics of your credit union.

- Maximize Efficiency and Minimize Complexity.

Sometimes, less is more.

- User Centric.

Are we making it easier, or harder, for our staff to complete their work and for our members to get the information they need?

- Untether Business Value from the Physical Structure.

Hello, Cloud. Service has been reinvented through our digital awakening, and the need and preference for remote service is front and center. Your building is not your service superstar; your people are.

- Cloud Secure and Compliant.

Will this strengthen your security posture?

- Technology Improvements to Achieve Business Goals.

Technology is not a silo. Technology is the artery of your service mission and main vessel for business growth and improvements.

- Vendor Agnostic Marketplace.

It’s a noisy marketplace. From vendor selection to contract management, independent business analysis can be your secret weapon to avoid common pitfalls.

To navigate this portion of the Cloud roadmap, start asking these strategic questions:

Where are you currently in your digital journey?

What is your technology adoption curve persona [ Are you an early adopter or an innovator?]

How will these improvements achieve your business priorities?

What is the opportunity cost of waiting or rejecting this proposed improvement?

The Cloud is not our future; it is our present. From business operations to user experience, a Cloud roadmap matures your credit union in a wholistic manner. These best practices help anchor technology and frames all choices into a greater lens. Not sure where to start? Vendor agnostic partners are standing by to position your credit union to crush your service mission.