And finally.... here’s our economics editor Larry Elliott on today’s stock market action:

Goodnight. GW

Biotech firm Moderna reports positive early results from coronavirus vaccine trial, as US central bank insists it can do more to protect economy

And finally.... here’s our economics editor Larry Elliott on today’s stock market action:

Goodnight. GW

Time for a recap

Global stock markets have enjoyed one of their best days since the Covid-19 pandemic struck, on hopes that stricken economies will return to more normal times soon.

A day that began with Japan sliding into recession has brightened considerably, thanks to biotech firm Moderna. It reported encouraging early signs that its candidate Covid-19 vaccine could be effective. Early testing has showed that it produced antibodies to neutralise the virus in eight patients - encouraging Moderna to press on with larger trials.

Federal Reserve chair Jerome Powell also boosted market confidence, by insisting that he has more ammunition to support the US economy if needed. Powell also warned that America could shrink by 20-30% this quarter, before starting to recover.

France and Germany also fuelled the rally, by surprisingly backing plans for a €500bn reconstruction fund backed by collective borrowing.

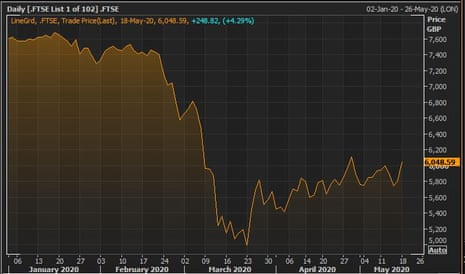

This all drove markets sharply higher, with the FTSE 100 posting its third-best day since the crisis began - up nearly 4.3% tonight.

Oil prices also rallied sharply, lifted by hopes of a pick-up in demand. Gold also strengthened, hitting a seven-year high as some traders anticipated a surge in inflation once the pandemic is over.

But there was gloom too. Germany’s Bundesbank warned that the economic slump will intensify this quarter, after Europe’s largest economy fell into recession late last week.

In the UK, property firm Intu asked its lenders to relax the covenants on its loans after it suffered a slump in rental payments from stricken retailers.

Budget airline Ryanair also savaged the UK government’s handling of the crisis... while discount supermarket chain Aldi teamed up with Deliveroo.

Our main UK Covid-19 liveblog is here, along with our global rolling coverage of the crisis:

Wall Street is holding onto its strong gains too, with the Dow up 820 points or 3.4% at 24,505.

But some of the companies who’ve thrived in the lockdown, such as video streaming service Netflix and video conferencing site Zoom, are missing out on the rally. That’s a clear sign that traders are anticipating a return to more normal economic times.

* Netflix: down 0.3%

— Carl Quintanilla (@carlquintanilla) May 18, 2020

* Peloton: down 5.8%

* Zoom: down 3.2%

* Clorox: down 1.5%

* Etsy: down 2.8%

* Gen Mills: down 1.3%

European stock markets have also posted very strong gains tonight, after a late surge as the Macron-Merkel news hit the wires.

Investors like the sound of a €500bn European Recovery Fund to fund economic reconstruction in parts of the EU most ravaged by Covid-19. Particularly if it comes as grants covered by all EC members (as today’s announcement appears to suggest...)

Here’s the full closing prices:

Edward Moya of OANDA sums up the day:

Many traders had a nice weekend as some normalcy crept back into their lives. The return of German soccer, Nascar, and golf provided many households with some fresh entertainment. The start of the trading week was supposed to have some optimism with the global economic recovery, but no one anticipated this Monday’s start.

Risk appetite is running wild after Moderna’s experimental vaccine showed promising early signs to create an immune-system response might be able to fight off COVID-19. Global equities are roaring higher on vaccine hopes combined with continued major economies reopening, and as the Fed continues to promise more stimulus is coming when it is needed.

Boom! Britain’s FTSE 100 index has just posted its third best day since the Covid-19 crisis began.

The blue-chip index of top UK-listed shares has closed 248 points higher at 6,048 points, a gain of almost 4.3%.

That’s the Footsie’s biggest one-day percentage jump since 25th March, when it started to recover from its pandemic-induced slump, and its highest closing level this month.

But as you can see, it is still down 20% this year:

Germany and France’s proposal for a joint rescue fund, on top of the encouraging vaccine news from Moderna, sparked a late surge into equities.

Nearly every member of the FTSE 100 rallied, led by cruise operator Carnival (+14%), mining giant Anglo American (+11.6%) and airline groups IAG (+11%) and easyJet.

In what looks like another significant development today, France and Germany have jointly proposed a new European Recovery Fund worth €500bn to help the region recover from the Covid-19 pandemic.

Importantly, this fund would be added to the European Union’s budget and used to support sectors and regions across Europe, through grants rather than loans.

The money would be raised through the financial markets by the Commission, meaning European member states would embrace the idea of joint borrowing

Merkel has told reporters that the plan would help Europe recover from Covid-19:

“We must act, we must act in a European way so that we get out of the crisis well and strengthened.”

here’s

Angela Merkel and Emmanuel Macron announce a € 500 billion Recovery Fund for the EU´s economic recovery after the crisis. The fund will be part of the EU budget and to support the hardest hit regions and branches. And: It should promote Europe's cohesion. 🇪🇺

— Stefan Leifert (@StefanLeifert) May 18, 2020

Marcon & Merkel announce a French-German 500-billion euro recovery fund that will be added to the EE budget, financed in the markets but the funds allocated to sectors and regions will NOT be loans but transfers.

— Thomais Papaioannou (@ThomaisERT_RIK) May 18, 2020

Merkel now suggesting the liability to be based on EU budget key, but dispersion based on need. So proper transfers through a fund but it seems like this would still increase member states’ liabilities.

— Pepijn Bergsen (@pbergsen) May 18, 2020

With 30 minutes trading to go, the UK’s stock market is sizzling.

The FTSE 100 index is now up 200 points, or 3.6%, back over the 6,000 mark for the first time in nearly a week.

Mining giants, energy companies, travel operators and other consumer-focused firms are leading the rally.

Tech companies and supermarkets, though, are lagging.

The oil price is pushing higher, lifted by hopes that lockdown restrictions will ease in the coming weeks and months.

Brent crude has hit $35 per barrel for the first sime since April 9th, up from $20 per barrel a few weeks ago (before production curbs helped to address chronic oversupply problems).

BRENT OIL RISES ABOVE $35 A BARREL FOR FIRST TIME SINCE APRIL 9

— First Squawk (@FirstSquawk) May 18, 2020

Moderna’s interim vaccine results have boosted hopes that the global economy can return to a more normal state, says Edward Park, Deputy CIO at investment manager Brooks Macdonald.

Park explains:

Moderna are one of the first companies to trial a vaccine for COVID-19 and early positive results have boosted sentiment. Moderna said that the vaccine helped boost the immune systems of participants to levels equivalent to the level of protection to patients who had contracted COVID-19.

Crucially, even if Moderna’s candidate vaccine doesn’t reach mass-market, today’s results offer the encouraging prospect that someone will achieve this feat.

As Park puts it:

Whilst Moderna’s success is still at an early stage, it helps improve the outlook not only for Moderna’s specific vaccine but raises the probability that COVID-19 can be vaccinated against. There are many viruses that have no specific vaccine therefore a continued risk is that COVID-19 can never be eliminated.

Moderna’s early stage successes appear to suggest that coronavirus can be vaccinated against which improves the outlook for a return to normality and shortens the timeline for economic disruption in the interim.

It’s important to note that Moderna’s phase one trial only included 45 participants (28 in Seattle and 17 in Atlanta, Georgia, according to USA Today).

Today’s results show that everyone tested so far has produced binding antibody levels similar to, or above, patients with Covid-19. These binding antibodies will stick to the virus. That can be a signal to the immune system to destroy the pathogen, but doesn’t actually stop it on its own.

They’re different to neutralising antibodies, which bind to the virus and also prevent it replicating (because they ‘stick’ to the pathogen in a way that neutralises it).

Moderna only has neutralising antibody results for eight participants -- four with small doses of the mRNA-1273 vaccine client and four at a larger dose. All eight have shown they do indeed have neutralising antibodies 43 days after injection - at or above levels seen in Covid-19 patients.

That’s encouraging enough for Moderna to press on with larger trials, as CEO Stéphane Bancel explains:

“With today’s positive interim Phase 1 data and the positive data in the mouse challenge model, the Moderna team continues to focus on moving as fast as safely possible to start our pivotal Phase 3 study in July and, if successful, file a BLA [biologics license application].

“We are investing to scale up manufacturing so we can maximize the number of doses we can produce to help protect as many people as we can from SARS-CoV-2.”

First #coronavirus vaccine tested in people appears to be safe and generates an immune response, its manufacturer, Moderna, announces.

— EHA News (@eha_news) May 18, 2020

Eight healthy volunteers made antibodies that were then tested in human cells in the lab, and were able to stop the virus from replicating. pic.twitter.com/4fmSgN4pZi

Shares in Moderna have jumped by 30% at the start of trading in New York, after the biotech firm reported early signs of progress in its Covid-19 vaccine test.

The broader market is getting a lift too, with Wall Street rising back to last week’s hgihs.

NEW: Moderna reports early signs of progress during its phase one #COVID19 vaccine trial. pic.twitter.com/uZgFylYBAB

— CNBC Disruptors (@CNBCDisruptors) May 18, 2020

Travel company shares are now soaring in London, on hopes that a vaccine breakthrough could, perhaps, help the global economy to emerge from the Covid-19 lockdown sooner than previously feared.

Budget airline easyJet are the top riser on the FTSE 100, up 11.5%, closely followed by cruise operator Carnival (+10%).

Mining companies are also rallying hard, suggesting that investors are slightly more optimistic about global growth prospects. Anglo American (+9%), BHP Group (+8%) and Rio Tinto (+7%) would all benefit from increased demand for iron ore, copper, coal and other commodities if economies recovered strongly from the current slump.

The few losers on the FTSE include supermarket chains Ocado (-1.2%) and Morrisons (-0.4%), whose sales have been boosted by the lockdown (although it’s also driven up their costs and created major supply chain challenges).

Wall Street is going to make a strong start to the week, when trading kicks off in 30 minutes:

*WALL STREET #FUTURES SOAR ON FED STIMULUS HOPES, MODERNA'S POSITIVE VACCINE TRIAL

— Investing.com (@Investingcom) May 18, 2020

*DOW FUTURES ✅ 720 POINTS, OR 3%

*S&P 500 FUTURES ✅ 2.8%

*NASDAQ FUTURES ✅ 2%

*RUSSELL 2K FUTURES ✅ 5.7%

*VIX ⛔ 8.4%

TRACK THE ACTION HERE: https://t.co/c2YtNoxoA3 $DIA $SPY $QQQ $IWM $VIX pic.twitter.com/ciQMbbp8bm

Comments (…)

Sign in or create your Guardian account to join the discussion