America's waiters and waitresses can't seem to get a break. Not only do they make a mere $2 to $5 an hour base salary in most places, now the tax man wants to make their lives more miserable.

Yes, the IRS is worried that people who typically make about $20,000 a year aren't paying enough in taxes. Why go after millionaires and billionaires when you can squeeze more out of servers?

In a new rule set to take effect in January, restaurants that charge an "automatic tip" have to treat that amount like a wage, not a tip.

This might sound like technical mumbo jumbo that only accountants and tax lawyers care about, but it's a big deal for American waiters, especially the ones who tend to work at low-end and mid-tier restaurants like Olive Garden, Texas Roadhouse and Applebee's.

It's become a fairly standard practice for US chain restaurants to add a gratuity (typically 15 to 18%) to the bills of parties over six or eight. Think about the last time you went out with a big group of friends, relatives or work colleagues. When it comes time to pay the bill, there are always a few people who are "bad at math". The tendency is for people to stiff the waiter on the tip – sometimes unintentionally – because they forget to add in that extra amount for tax and tip or they believe someone else is going to take care of it. When everyone puts a dollar or two less in than they should, it can turn into a really bad day for the waiter.

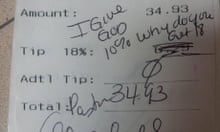

Just ask Chelsea Welch, the former Applebee's waitress who made headlines in February when one woman in a large group she was serving left $0 tip and a note that said "I give God 10%. Why do you get 18?" It was a bizarre incident that quickly went viral when Chelsea posted the bill on Reddit to make a point: "tips are not optional. They are how waiters get paid in America."

Sure, it would be great if America had a system more akin to Europe where servers are paid a better base salary and are less reliant on the whims of their customers for tips. But that's not the system the US has.

While there's a perception that waiters just pocket tips black market style, the reality is they have to report them to the IRS on a monthly basis and tally them up at the end of the year. Tips are taxed just like any other salary or income. Yes, sometimes tips, especially cash ones, aren't reported fully, but the IRS has cracked down on that in recent years.

So from the IRS' perspective, all tips are going to be taxed anyway. What difference does it make if automatic gratuities are taxed right away (like base wages) or later (like tips)? According to a spokesman, the IRS is doing this rule change because "additional clarification in this area would be in the best interest of tax administration".

The problem is the IRS doesn't understand the real world, especially the world of low and middle income America.

The reason servers in the US love tips is because they know at the end of each day how much they got. They get to take that money home that night. Yes, they will have to report it and pay some tax on it later on, but they get that cash in hand right away.

If restaurants have to start treating automatic gratuities as wages, then the waiter doesn't get that money that same night. It would come as part of a formal paycheck – often handed out every two weeks – and taxes would already be taken out. To put it another way: it would take longer to get the money and it would be less up front. That's not good for a college student or parent trying to earn extra for day-to-day life.

Restaurants are already threatening to end automatic gratuities because it would be an administrative nightmare to do what the IRS now wants. Several chains told the Wall Street Journal they would switch to putting "suggested tip amounts" of 15% 18% and 20% on bottom of the bill. Hopefully diners will be generous and it will work out better for waiters, but having watched large parties leave waiters closer to 10 or 12% before, I'm not so certain.

This issue might seem like "small potatoes", but when some of the country's largest corporations get away with paying next to nothing in taxes (pdf), you have to wonder why garnering a few extra dollars from waiters is a big priority.