Latest News, Articles and Presentations...

FocalPoint Analytics' important comment on Axion Power's recent Financing Transaction -- On reading the Axion power concentrator, I get the impression that some people do not understand many of the ramifications of Non-Conventional convertible security financing (PIPEs). So I thought it would be helpful to provide some information on the subject.

HTL's latest insta provides the perfect forum for this information with its close proximity to his data. Thank you very much HTL for letting me post this here.

===

A Note on Convertible Securities, Specifically Non-Conventional PIPE Financing. I have added some additional materials in brackets [ ].

The following is from the SEC website http://tinyurl.com/3bnmd9

A "convertible security" is a security, usually a bond or a preferred stock that can be converted into a different security, typically shares of the company's common stock.

Companies generally issue convertible securities to raise money. Companies that have access to conventional means of raising capital (such as public offerings and bank financings) might offer convertible securities for particular business reasons. Companies that may be unable to tap conventional sources of funding sometimes offer convertible securities as a way to raise money more quickly.

Conventional convertible security financing

In a conventional convertible security financing, the conversion formula is generally fixed. This means that the convertible security converts into common stock based on a fixed price. The convertible security financing arrangements might also include caps or other provisions to limit dilution.

Non-Conventional convertible security financing

By contrast, in less conventional convertible security financings, the conversion ratio may be based on fluctuating market prices to determine the number of shares of common stock to be issued on conversion.

A market price based conversion formula protects the holders of the convertibles against price declines, while subjecting both the company and the holders of its common stock to certain risks. Because a market price based conversion formula can lead to dramatic stock price reductions and corresponding negative effects on both the company and its shareholders, convertible security financings with market price based conversion ratios have colloquially been called "floorless", "toxic," "death spiral," and "ratchet" convertibles.

[ It's important to understand the meaning of Ratchet, so here is its definition: Ratchet - The option for existing shareholders in some publicly-traded companies to exchange their shares for more shares in a new issue of stock where the newly issued stock is made at a lower price.

For example, if a shareholder purchases shares for .30 per share and the company later makes a new issue at .15 per share, the shareholder may exchange the shares purchased at .30 for an equivalent dollar amount in .15 shares. This doubles the number of shares obtained in this example. http://tinyurl.com/yke.... The Axion notes have a full ratchet adjustment - page 45 of the S1. ]

Both investors and companies should understand that market price based convertible security deals can affect the company and possibly lower the value of its securities. Here's how these deals tend to work and the risks they pose:

* The company issues convertible securities that allow the holders to convert their securities to common stock at a discount to the market price at the time of conversion. That means that the lower the stock price, the more shares the company must issue on conversion.

* The more shares the company issues on conversion, the greater the dilution to the company's shareholders will be. The company will have more shares outstanding after the conversion, revenues per share will be lower, and individual investors will own proportionally less of the company. While dilution can occur with either fixed or market price based conversion formulas, the risk of potential adverse effects increases with a market price based conversion formula.

* The greater the dilution, the greater the potential that the stock price per share will fall. The more the stock price falls, the greater the number of shares the company may have to issue in future conversions and the harder it might be for the company to obtain other financing.

[At this point I think it's important to get a feel for the amount of dilution that could be encountered. I refer the reader to the table on page 42 of the S1 entitled: "Number of Shares Issuable in Satisfaction of the Senior Convertible Notes Based on Various Assumed Conversion Prices". That table shows the number of shares that will be issued based on different conversion prices. The current share price is already less than the lowest share price in that table.

If we rough fit a linear function and put in Friday's closing price (.153) we get 56,054,886 shares which is about 59% more shares than the number of issued shares at .264.

If you look again at the S1 on page 44 you will see that the Shares Registered for Resale on behalf of the Selling Stockholders or Affiliates Thereof in Connection with the Senior Private Placement is 61,327,781. Axion has extra shares, but if the stock price drops down to around .125, all of the additional placement shares could be absorbed. If the price drops to book (.07 - .08) we are talking around 71M shares. Can that happen, I don't know, but I think its something that should be discussed.

Finally, I have looked and looked in the S1. I don't see any floor on the conversion price. If that is true, there is no lower limit on the conversion price. Now back to the SEC's note.]

Before you decide to invest in a company, you should find out what types of financings the company has engaged in - including convertible security deals - and make sure that you understand the effects those financings might have on the company and the value of its securities.

If the company has engaged in convertible security financings, be sure to ascertain the nature of the convertible financing arrangement - fixed versus market price based conversion ratios.

Be sure you fully understand the terms of the convertible security financing arrangement, including the circumstances of its issuance and how the conversion formula works. You should also understand the risks and the possible effects on the company and its outstanding securities arising from the below market price conversions and potentially significant additional share issuances and sales, including dilution to shareholders.

Short Selling

You should be aware of the risks arising from the effects of the purchasers and other parties trading strategies, such as short selling activities, on the market price for the company's securities, which may affect the amount of shares issued on future conversions. [Note HTL's comments on shorting]

===========

Senior Warrants:

In addition to the shares offered from the convertible notes, the S1 also entitle Senior Warrants consisting of 17,281,107 million shares of common

Stock. The Senior Warrants will not be exercisable until the six month anniversary of the Closing and will expire 5 years from the date of first exercise. The Senior Warrants are initially exercisable at an exercise price equal to $0.302, subject to certain adjustments. One of those adjustments is a "full ratchet" anti-dilution adjustment.

What's happened to the share price?

If you are thinking of buying shares in a company that is currently under the terms of Non-Conventional convertible security financing, I suggest looking at the share price history since the PIPE arrangement began. If the stock exhibits a sharp downward trend in temporal proximity to the start of the PIPE, that very likely means the share price is in a dilutive spiral.

Even if the company receives good news that increases share price, the dilutive pressure of the Non-Conventional convertible security financing will continue until the terms of the PIPE are completed.

So what do you do - Buy, hold, sell, trade? It depends on a lot of things... I just wanted to make sure that people understood the kinds of risks that can exist under this type of financing.

--------------------------------------------------------------------

Axion Power Receives Order To Supply Class 8 Truck Battery Strings For ePower

--------------------------------------------------------------------

Axion Power Reports First Quarter Results For 2013-Press Release

Excerpts from the First Quarter 10-Q --

--------------------------------------------------------------------

--------------------------------------------------------------------

Axion Power on Panel at Energy Storage Economics 2.0 for New YOrk City and Beyond --

--------------------------------------------------------------------

Axion Power's CEO Discusses Q4 2012 Results - Earnings Call Transcript

--------------------------------------------------------------------

Axion Power Reports Results for 2012 --

--------------------------------------------------------------------

Axion Power Completes New Continuous Roll Carbon Sheeting Process

--------------------------------------------------------------------

--------------------------------------------------------------------

Dr. Ed Buiel, Axion's CTO until the end of 2010 -- A link to an archive of his comments on yadoodle about the PbC battery and much more. Invaluable commentary! Thanks to 481086 for putting the list together.

Axion Power PbC Batteries Continue To Demonstrate Effectiveness For Railroad Applications -- Axion completed shipping its high-performance PbC batteries to Norfolk Southern Corp. (NS), one of North America's leading transportation providers, for use in Norfolk Southern's first all electric locomotive - the NS-999.

Axion Power Residential Energy Storage HUB Certified to UL, CSA Standards -- Axion receives UL certification and CSA Standards for their Residential Energy Storage HUB.

"ePower's Series Hybrid Electric Drive - Unmatched Fuel Economy for Heavy Trucks" -- by John Petersen. Discusses the potential fuel savings for ePower's Hybrid electric drive for class 8 trucks using Axion's PbC batteries.

"Axion Power - A Battery Manufacturer Charging Forward" -- by John Petersen. This is an excellent summation on Axion Power's history. It is a good starting point for introducing Axion Power to friends and family.

--------------------------------------------------------------------

Axion Power Weighted Moving Average Prices and Volume:

(updated through 07/01/2013)

Since everybody is familiar with the three graphs I send the Axion Power Host every week and anything repetitious will get boring after a while, I thought I'd mix things up a bit and offer a completely different presentation.

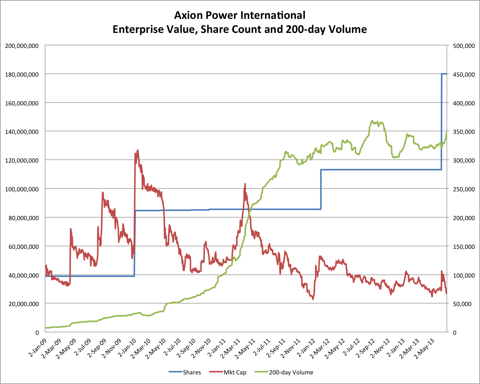

The following graph shows how Axion's share count has grown over time, how its 200-day average trading volume has grown over time, and how its aggregate enterprise value has fallen by almost 75%. For purposes of the enterprise value calculation (which is theoretically equity plus long-term debt), I've treated the recent PIPE as a stock issuance and arbitrarily assumed that 66.7 million shares will be issued to retire the debt. I hope the number of new shares will be closer to the 37.8 million shares that management intended, but a little pessimism doesn't hurt when engaging in this kind of exercise.

The events that increased Axion's market capitalization during 2009 were:

· The April 2009 announcement of a strategic alliance with Exide;

· The August 2009 announcement of a DOE grant award to Exide with Axion Power; and

· The December 2009 completion of a $26 million private placement.

Since April 2010, the selling pressure has been heavy enough to completely eclipse all of these events:

· The June 2010 disclosure of a development relationship with Norfolk Southern;

· The September 2010 disclosure of a development relationship with BMW;

· The March 2011 disclosure that a major US automaker had joined Axion as a subcontractor in a major DOE grant application;

· The November 2011 commissioning of the PowerCube as the first behind the meter frequency regulation resource in the country;

· The December 2011 discovery that the unnamed US automaker was General Motors;

· The February 2012 completion of a $9 million offering of common stock;

· The April 2012 announcement that Norfolk Southern had completed its laboratory testing and ordered batteries for its NS 999;

· The August 2012 disclosure that BMW had completed its laboratory testing and commissioned an independent peer review;

· The August 2012 disclosure that a Top-5 Asian automaker had decided to go directly to advanced testing on the strength of the BMW test results;

· The November 2012 disclosure that a testing program for the use of the PbC in auxiliary power units for Class 8 trucks was expected by year-end;

· The November 2012 disclosure that the PbC had been selected for use in a new series hybrid electric retrofit for Class 8 tractors;

· The tacit admission by Exide that its best enhanced and AGM batteries won't stand up to the demand of micro-hybrids in November 2012;

· The frank admission by JCI that its best enhanced and AGM batteries won't stand up to the demand of micro-hybrids in December 2012;

· The December 2012 shipment of the NS 999 batteries to Norfolk Southern;

· The signing of an exclusive supply arrangement with ePower following successful testing of the PbC in their tractor;

· The March 2013 commissioning of an automated carbon sheeting line that strips 80% of the labor out of the PbC battery while improving performance;

· The April 2013 disclosure that Axion, with support from BMW, was pursuing production with first tier automotive battery manufacturers; and

· The May 2013 completion of a $10 million self-liquidating convertible note offering.

While I find the list of accomplishments impressive, the oddity I want to point out is that Axion's enterprise value fell when the company announced the completion of the 2012 registered direct stock offering and it fell yet again when the company announced the completion of the 2013 PIPE. In both cases Axion had about $10 million more cash after the deals than it did before the deals and it's aggregate enterprise value (which includes the newly issued shares) fell.

In March of 2010 Axion's enterprise value stabilized in the $100 million range before the stock price began to suffer from unrelenting selling activity from a few large holders. Over the next three years the 200-day average volume ramped from 34,000 shares a day to 340,000 shares a day. Despite an impressive list of accomplishments the market capitalization fell gradually from $100 million to the current level of roughly $27 million.

The only credible explanations for the inconsistent outcomes are:

1.Battle fatigue because of the brutal selling we've witnessed over the last three years;

2.The questionable presumption that bottom fishers paid fair value over the last three years; and

3.Irrational fear that the successes Axion has accumulated over the last three years will have no value.

--------------------------------------------------------------------

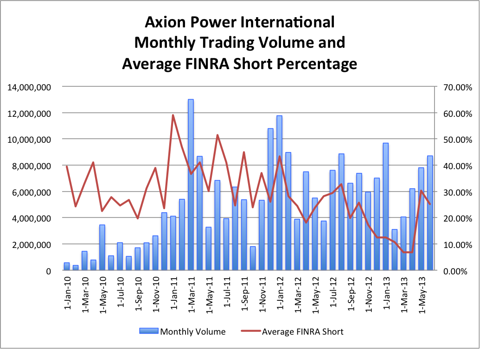

Axion Power Monthly Volume versus FINRA Short Percentage:

(by John Petersen)

In late January I wrote an Instablog about the precipitous decline in reported FINRA short sales as a percentage of total trading volume. Over the last two weeks that trend has accelerated and the percentages for the month of February and the last four weeks are solidly in single digits. I view this graph as another confirmation of seller exhaustion. The big uglies are history and it looks like everybody who really wanted to sell already has.

John Petersen's instablog here.

--------------------------------------------------------------------

Links to important Axion Power research and websites:

The Axion Power Concentrator Web Sites, created by APC commentator Bangwhiz. It is a complete easy-to-use online archive of all the information contained in the entire Axion Power Concentrator series from day one, including reports, articles, comments and posted links.

Axion Power Wikispaces Web Site, created by APC commentator WDD. It is an excellent ongoing notebook aggregation of Axion Power facts.

Axion Power Website. The first place any prospective investor should go and thoroughly explore with all SEC filings and investor presentations as well as past and present Press Releases.

Axion Power Intra day Statistics Tracking: (updated 7/1/2013) HTL tracks and charts AXPW's intra-day statistics.

PbC Cost Estimating Spreadsheet and Instablog: Apmarshall62 put together an instablog for estimating costs of the PbC. It includes a downloadable spreadsheet that you can use to plug in your own cost estimations.

--------------------------------------------------------------------

Be sure and either follow the Axion Power Host ID on Seeking Alpha or click the check-box labeled "track new comments on this article" just ahead of the comments section!

--------------------------------------------------------------------

WARNING: This is a troll free zone. We reserve the right to eliminate posts, or posters that are disruptive.

Enjoy!

Disclosure: I am long AXPW.OB.