9.14am: It is fast becoming crunch time for the UK economy. Today we will get a better picture of whether the UK is headed for a double dip recession.

First up, in just over a quarter of an hour is the latest UK unemployment data, which is expected to show a further rise in the number of long-term unemployed. Perhaps most worrying is the rise of long-term youth unemployment. This country is fast developing a new 'lost' generation.

Overnight, a new TUC report has warned that the number of young long-term unemployed people is rising across two-thirds of the country and the situation is likely to be exacerbated by the coalition government's planned public sector jobs cull.

Then at 10.30 the Bank of England Inflation Report is scheduled to be published. The bank is expected to reduce its growth forecasts on the basis that the chancellor's plans to slash public sector spending will have a knock-on effect on the wider economy.

At the same time, however, its inflation forecasts could well be raised to account for the government's planned VAT increase next January.

That leaves the possibility that rates will have to be raised, not because consumer confidence or corporate investment is on the increase - ie the economy is in better shape - but as the direct result of a tax-raising measure which the bank must to take into account as it tries to meet the government-set target of 2% consumer price inflation.

The VAT rise may not just derail consumer spending - as some retailers are already warning - it might actually cause rates to go up, potentially deepening the crisis.

Then at lunchtime we will round-off this blog with the release of US trade figures which are likely to back-up the US Federal Reserve's decision yesterday to keep rates unchanged and pump extra liquidity into the financial system through an operation described as a "light" version of quantitative easing.

The recovery is slowing, the Fed's open market committee warned yesterday. As far as the global recovery is concerned the recovery is looking "more modest in the near term".

9.29am: So what to expect from all this data today.

ING Markets has produced a nice summary of the economic news from overnight, with a few predictions for today.

US: Bernanke waves his magic wand again – FOMC statement

A downgrade of the economic situation, and re-investment of MBS proceeds into Treasuries.

UK: BoE – inflation still no threat

BoE forecasts are likely to become more pessimistic on growth, yet inflation in the near term will likely be higher before dropping back below target in two years.

Japan: Disappointing Machinery Orders in June

Sluggish result suggests business investment may have declined in Q2

France: Industrial production tumbles

In spite of the drop in June, there is still scope for a further increase of industrial activity in France. However, the recovery could take place at a rather slow pace.

EMEA

Russia: Federal budget deficit widens

The gap was 2.2% of GDP in 7M10, and it still might undershoot the official 5.4% target for 2010. The lower gap leaves the MinFin with more flexibility in terms of both the schedule of new bond placements and acceptable yield.

Ukraine: Monetary aggregates still see moderate growth

The growth in monetary aggregates has been moderate and should not be a core reason for inflation accelerating this year. In any case, the NBU will maintain its control over money supply in order to keep prices stable.

Ukraine: NBU lowers the discount rate to 7.75%

ASIA

China: More Evidence of Hard-Landing

Weakening domestic demand reinforces our forecast that the PBOC will do nothing to alter its accommodative policy settings in the rest of the year.

Korea: The BOK Policy Meeting Preview

We forecast another 25bp BOK rate hike tomorrow but are prepared to be proved wrong.

Gary Jenkins at Evolution Securities reckons the FOMC decision overnight "looks a little like a sop to the market that had been calling for further quantitative easing in the light of weaker than expected economic data".

It probably buys the Fed time whilst it waits to see if there is any real clarity in the economic outlook, but that's about it. It is difficult to see why this action would lead to a significant difference in growth or employment in the short term. It was of course only a few short months ago that the Fed was spending more time examining how to tighten monetary policy which shows you just how "unusually uncertain" the outlook is. Anyhow the market got its latest fix but the concern is that the hit will last a shorter period this time and soon another one will be demanded. All will depend upon the economic data. What is fascinating though is that there may well be a very different approach to this crisis developing in Europe where austerity is the order of the day, and yet both the US and Europe would appear to be facing the same deflationary pressures.

Turning to today's fare, his eyes are firmly set on the Bank of England's quarterly inflation report which he sees as "likely to push out the above-target inflation outlook, while simultaneously cutting the Bank's GDP forecast".

As for the unemployment data "the claimant count rate is seen to have remained unchanged in July at 4.5%, with jobless claims expected to be down 17,000. The June ILO unemployment rate is expected to remain unchanged from the previous month at 7.8%. Average Weekly Earnings are expected at 1.0% year-on- year (3 month average); down from 2.7% last month, Earnings ex-bonus is seen at 1.6%.

As for the US trade data, consensus forecast is for a $42.3bn trade deficit in June.

Lloyds TSB's corporate markets economic research division. meanwhile, is focused on the Bank's report:

Nine months into a cyclical recovery and the debate over UK monetary policy has become increasingly finely balanced. On the one hand, the pick-up in growth and the elevated level of inflation have strengthened the case for a pre-emptive rise in interest rates to start soon. On the other, the degree of uncertainty about the durability of the recovery and the potential disinflationary forces that could yet emerge have raised the possibility that more, not less, stimulus may be required. So which is it - should sterling markets brace themselves for an impending rise in interest rates; or should they be prepared for a renewed round of policy stimulus to stave off the risk of a double-dip recession?

Investec Securities tries to give some answers. In its outlook published earlier in the week it adds:

Although, the MPC decided to leave policy unchanged in August, we think this belies an active discussion and differing views on the Committee and the final decision was likely heavily guided by the Inflation Report's medium-term projections. We expect to see growth forecasts nudged down gently from here, officially recognising the greater fiscal tightening. However, inflation has proven more persistent in the short-term and the announced increase in VAT in January will likely keep CPI above target for much of 2011. A firmer near-term inflation outlook is likely to give way to a softer outlook in the medium-term (reflecting expected weaker growth). The policy read through would not be clear from these projections and much will depend on the MPC's consideration of the risks. We think a revival in financial market sentiment will have allayed some of the Committee's fears to the downside. Upside inflation risks will likely persist in the near-term.

It is, however, worth remembering how wrong the economists have got things in the past. As the Sun's business editor Steve Hawkes notes on Twitter

Wonder how many of these economists warning of a double-dip actually correctly forecast the recession a few years back?

9.43am: The UK unemployment data is out and it's a "mixed bag" according to our economics expert Katie Allen:

It shows the number of people out of work and claiming jobless benefits fell far less than expected in July. The drop of 3,800 was well below forecasts for a 16,500 fall. At the same time official data for the three months to June - a quarter when UK economic growth rebounded dramatically - showed the employment level recorded its biggest jump since 1989. But mirroring the trend of recent months most of that was down to new part-time jobs suggesting firms are still too cautious to take on full-time staff. In reassuring news for the Bank of England as it battles to get inflation in check, wage inflation in the quarter moderated dramatically. In the smallest rise for pay growth since January, average earnings were up an annual 1.3% in the three months to June. That was well below 2.7% in the three months to May but above forecasts for 1.1%.

9.59am: The jobs data "hints that the improvement in the labour market may be faltering" according to Howard Archer, chief European & UK economist at IHS Global Insight:

For now at least, unemployment continues to fall in reaction to the economy's ongoing growth since the fourth quarter of last year. However, it is notable that claimant count unemployment fell by a modest 3,800 while June's drop was trimmed to 15,900. This is well down down from the declines around 30,000 seen in May and April, and hints that the improvement in the labour market may be faltering.

On a more positive note, there was an increased drop of 49,000 in the three months to June on the ILO measure while employment spiked up by 184,000. Again, it is notable that this was led by a 115,000 jump in part-time employment, which indicates that many companies are still reluctant to add full-time workers amid concerns over the longer-term strength of the recovery. However, full-time employment did rise at an increased rate of 68,000.

Given that it is the most timely measure of unemployment, the reduced drop in claimant count unemployment adds to the uncertainty over the longer-term outlook for the jobs market. While unemployment will probably fall further in the near term, we suspect that it could very well start heading back up before the end of the year and then increase further in 2011. Major job losses are on the way in the public sector as the government slashes spending, and we doubt that the private sector will be able to fully compensate for this. Specifically, we see unemployment on the ILO measure peaking around 2.85 million in the first half of 2012, with the unemployment rate reaching 9.0%.

Meanwhile, wage growth remained muted in June. It still seems highly unlikely that wage pressures will pose an inflationary threat anytime soon, which supports the case for the Bank of England to keep interest rates down at 0.50% for many months to come. Even if inflation expectations rise further, this is unlikely to translate into markedly increased pay awards given high unemployment and the uncertain labour market outlook. Indeed, with wage growth muted and a major fiscal squeeze increasingly kicking in, it is hard to see consumer spending being anything else than muted for an extended period.

Vicky Redwood, senior UK economist at Capital Economics adds:

The latest UK labour market report has a generally positive tone. Employment in the three months to June rose by a whopping 184,000, with full-time employment accounting for a decent proportion of that. And although the number of people looking for jobs also rose sharply, unemployment still fell by 49,000. However, the relatively small fall in the timelier claimant count measure of unemployment of just 3,800 in July is a slight cause for concern. June's drop was also revised from 20,800 to a smaller 16,000. This might be a sign that the slowdown in the wider economic recovery is already spreading to the labour market. And with sharp public sector job cuts looming, we still think that renewed rises in unemployment lie ahead. What's more, the high level of unemployment continues to dampen pay growth. Admittedly the fall in headline average earnings growth is primarily a bonus effect. But excluding bonuses, headline growth slowed from 1.8% to 1.6%. Consumers' incomes still look set to be tightly squeezed over the next couple of years.

10.22am: In an extensive note amusingly entitled "A tale of two central banks" Charles Stanley analyst Jeremy Batstone-Carr looks ahead to the Bank of England report in less than 15 minutes time:

The inflation profile is expected to be revised up in the near-term. Previously the Bank expected inflation to fall sharply through both 2010 and 2011 with CPI at around 1.4% in two years' time. This was on the basis that the VAT hike from January this year would drop out of the annualised calculation from December and the "persistent margin of spare capacity" would exert a downward influence. VAT is now going to be raised to 20% from January 2011, implying that inflation will remain above target for longer than previously thought.

Nonetheless, the weaker activity forecast and strong sterling should depress inflation over the medium / longer term, especially now that inflation expectations amongst both the financial markets and households has started to fall. This implies little risk of so-called "second round" effects from higher wage demands and a strong chance that the Bank's two year inflation forecast will be below 2%, especially since the January 2011 VAT hike will have dropped out of the annualised comparison by then.

In conclusion we expect the Bank to signal little or no prospect of any base rate hikes until well into 2011 at the earliest. Moreover, the possibility remains that the Bank may be forced into further expanding its asset purchase scheme in an effort to support what activity there is and prevent longer term inflation falling too far. Growth risks remain significant and are entirely evident in the US. The risk could grow should the eurozone sovereign debt crisis reignite which could, in turn, result in the credit markets seizing up again.

10.29am: The jobs data "hints that the improvement in the labour market may be faltering" according to Howard Archer, chief European & UK economist at IHS Global Insight

Vicky Redwood, senior UK economist at Capital Economics adds "the relatively small fall in the timelier claimant count measure of unemployment of just 3,800 in July is a slight cause for concern".

June's drop was also revised from 20,800 to a smaller 16,000. This might be a sign that the slowdown in the wider economic recovery is already spreading to the labour market. And with sharp public sector job cuts looming, we still think that renewed rises in unemployment lie ahead. What's more, the high level of unemployment continues to dampen pay growth. Admittedly the fall in headline average earnings growth is primarily a bonus effect. But excluding bonuses, headline growth slowed from 1.8% to 1.6%. Consumers' incomes still look set to be tightly squeezed over the next couple of years.

10.32am: Here's the rundown of the employment figures from earlier in the morning:

Claimant count unemployed

July June forecast

-3,800 -15,900 -16,500

ILO jobless (millions)

April-June Jan-March April-June 2009

2.457 2.506 2.433

ILO jobless rate

April-June Jan-March April-June 2009

7.8 (f/cast 7.8) 8 7.8

Average weekly earnings 3mth yy (pct) +1.3 +2.7 +1.1

10.33am: Governor of the Bank of England Mervyn King is now speaking at a press conference as the bank publishes its quarterly inflation report.

As expected he opens his remarks by saying "the overall outlook is weaker than that expected in the May report".

10.36am: The Bank of England has cut its forecast for GDP growth and admitted that inflation will be above the 2% target until the end of 2011 - significantly longer than the Bank had predicted in May.

Should you wish to listen in, go here.

10.40am: Here are the thoughts of Katie Allen on the Bank of England report:

The Bank of England has cut its growth forecast, highlighting pressures from the government's fiscal squeeze and weaker business and consumer confidence. Governor Mervyn King has just started presenting the Bank's quarterly inflation report. He says inflation will be higher than last expected in 2011 on the back of the VAT rise in January but then will fall back significantly the year after. Markets have taken the forecasts as a signal rates will remain at their record low of 0.5% for many months to come. The pound is weaker and government bond futures are rallying. King appears to remain very cautious about the growth outlook. As he says "Whereas crises appear suddenly, they fade only gradually." But he also insists the BoE has not taken its eye "off the inflation ball".

10.54am: Speaking to journalists after the publication of the quarterly inflation report, Mervyn King has admitted that the credit crunch has not eased as fast as the Bank of England had expected when it worked on its forecasts at the end of 2009.

"We are certainly concerned about the fact that credit conditions have not eased as quickly as we had expected," he said.

Businesses - especially small businesses - have been complaining that banks are not lending the money that they desperately need in order to invest in order to grow.

11.00am: Just to recap what has happened so far this morning:

The Bank of England has cut its predictions for economic growth from 3.5% to nearer 3%. (10.36am)

Inflation will soar above the government's 2% target until the end of 2011 – significantly longer than projected in May - because of the planned VAT rise. (10.33am)

Governor Mervyn King has warned that the UK faces "a choppy recovery" and banks are not lending as fast to businesses as he had expected six months ago. (10.54am)

The number of people claiming jobless benefits fell far less than expected last month while long-term unemployment soared to its highest level in 13 years, according to new government figures. The number of people unemployed in the UK fell by 49,000 to 2.46 million in the three months to June. But the claimant count figure – the labour market report's most up-to-date indicator – showed a drop in those getting benefits of just 3,800. That was well below forecasts for a 16,500 fall. June's fall was also revised lower. (9.43am)

11.21am: In his comments to journalists after the release of the inflation report, King denied that banks are being "bloody minded" in the way that they lend their cash.

He said "they are facing higher costs of obtaining funding" themselves and that is why the cost of bank lending is so high.

Large companies, of course, can circumvent the banking system - which King admitted "is still badly damaged" - by raising cash through issuing bonds or shares to investors.

Smaller companies, however, do not have that luxury and so are facing a cash squeeze.

11.26am: Following the Bank of Engalnd's downbeat assessment of the economy, the FTSE 100 index is down almost 100 points at 5,279 points.

11.34am: The pound is down against the dollar after the Bank of England report, touching a one-week low of $1.5736

11.37am: Reaction to the Bank of England's lengthy report is coming in. Over at Capital Economics, chief European economist Jonathan Loynes strikes a surprisingly upbeat tone:

The Bank of England's August Inflation Report looks rather more dovish than generally anticipated. Although the CPI inflation forecast (based on market rate expectations) has been pushed higher over the next year or so – partly reflecting the planned rise in VAT - it has been pushed down further ahead in response to a rather weaker outlook for GDP growth, itself partly reflecting the additional fiscal squeeze announced in the emergency budget. As such, inflation is still expected to be well below the MPC's 2% target at the two-year horizon and beyond.

Most strikingly, even the forecast based on unchanged interest rates and QE (quantitative easing) is also well below target in two years, implying that the Committee thinks that a policy loosening is more likely to be needed than a tightening. Of course, Governor Mervyn King stressed again that there are large risks around the forecasts, in both directions. As such, it may take a more obvious slowdown in the economy to prompt the majority of MPC members to vote for a further bout of quantitative easing. But that may well materialise. And if nothing else, there is further support here for our long-held view that interest rates are going nowhere for a long time.

11.42am: Over at ING Financial Markets, chief international economist Rob Carnell says that while the data in the report is positive:

Governor Mervyn King, sounded a good deal more cautious on growth than these figures suggest, re-iterating the downside risk to growth.

ING's view of growth remains around half that of the Bank (1.5% 2011 and 2012) while the unemployment data this morning was also "disappointing" which suggests "recent GDP strength will not persist over the rest of the year". He concludes:

With ongoing economic weakness, and downside risks around the inflation outlook, the UK probably offers greater scope for a re-expansion of Quantitative easing compared to the US, which made a tentative move in that direction last night.

11.47am: Our very own Katie Allen wades in on the debate about lending, having listened to Mervyn King's morning press conference.

King is making some interesting comments on the debate over small businesses struggling to get bank loans. The BoE governor says small businesses are carrying the burden of tight lending and the Bank is "certainly concerned about the fact that credit conditions have not eased as quickly as we had expected." But he stops short of blaming the banks. Small businesses accuse them for placing unsustainable conditions on loans but King argues the bank's themselves are damaged by the credit crunch and also struggle to get credit. It is not a question of "blaming people", he says. "I'm not saying they should do more. It's an economic question," he tells the press conference. The problem is, he says, that bigger firms can get money in other way such as by issuing shares or corporate bonds. That's not an option open to smaller businesses. And he is gloomy about any quick improvement. "The lessons of history are that it takes a long time" for balance sheets to repair in the financial sector and elsewhere.

The question of whether banks are doing enough to help businesses is one that we have followed closely. For both sides of the debate go here

11.51am: Not had your fill of economics yet? You can get the whole Bank of England statement here.

12.07pm: The pound continues to slump against the dollar. While the BoE predicts that inflation will rise in the short-term, its forecast that after 2011 it will be back under the government's 2% target has hit the currency. The pound is down more than 1% at $1.5667.

12.18pm: Howard Wheeldon, senior strategist at BGC Partners, reckons the BoE report shows that the recovery continues "but in terms of both growth and inflation the outlook now moves slightly more toward increased downside risk".

That may be a quick summary of the eagerly awaited Bank of England Quarterly Report which talks far more this time about risk and far less about any degree of certainty that inflation will automatically fall or that growth can be guaranteed. Indeed chances of inflation hitting 2% over the next year look very thin indeed. And while the report and the subsequent comments from the BoE governor Mervyn King have remained generally upbeat and that the view of the Bank is that the recovery process continues we must note that this has not stopped the Bank making a sizable downward revision to 2011 GDP growth expectation.

Our brief conclusion to the BoE report is that while we note the increased risk to the downside we are somewhat surprised that the message remains quite so optimism in terms of 2011 and 2012 growth expectation and particularly the expectation of increased exports. However, we are pleased that there is no sense that the Bank plans to overreact to inflation being higher than the government target.

12.22pm: Jeremy Cook, from currency exchange broker World First takes a look at the currency markets and reckons "traders are going to weigh on the pound in the coming sessions". The pound's slide continues.

12.27pm: The Bank's inflation report does not provide cut and dried exact predictions of what the economy will look like in the future. Instead it relies upon so-called fan charts, which show the upper and lower limits of the Bank's estimates.

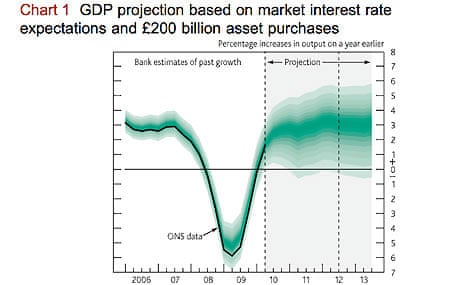

From those charts, of course, you can estimate a headline figure. So today's report sees the Bank cut its forecast for GDP growth to 3% from the 3.6% predicted last May. Here is the GDP chart:

What is interesting about the above chart is that the width of the fan gives an indication of the level of uncertainty about the forecast. You would expect that over time the range of estimates would 'fan out' widely (things further out in the future being, of course, harder to predict). But what is striking about the chart is how quickly the fan increases in size. That is a measure of just how uncertain the current economic climate is.

12.48pm: Rick has scarpered for a well-earned break, so this is Graeme Wearden taking over for the run-up to the US trade data (due at 1.30pm).

As we mentioned earlier, the FTSE 100 is not a pretty sight this morning. Currently down 83 points at 5293, with a measly six risers (Smiths Group is the best of the bunch, in case you're tracking your pension).

We're likely to see a sell-off on Wall Street when trading begins, unless the trade data is seriously upbeat. Traders are predicting that the Dow Jones will drop by around 130 points at the open, from 10644 overnight. This follows yesterday's downbeat words from the Federal Reserve.

As David Buik of BGC Partners put it:

We all feared that the US economy was treading water and Ben Bernanke confirmed that fact in telling the market after the FOMC had concluded that the recovery had slowed down and inflation was very subdued, which to all intents are purposes downgrades the US economy with monetary policy bias shifting towards easing.

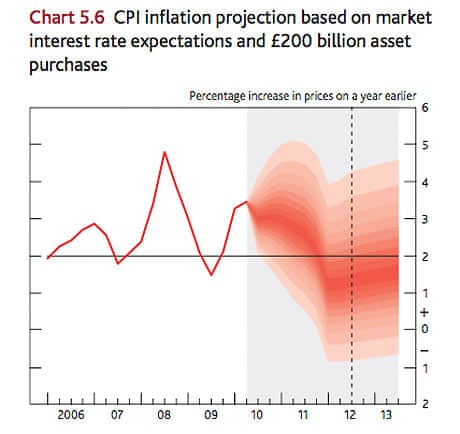

1.03pm: Back to the charts from the inflation report. As well as showing you the breadth of uncertainty in the economic forecasts (see previous post), the fan also shows you in which direction the bank expects a particular indicator to go.

So the inflation chart (above) shows very clearly that the Bank expects inflation to be well above the government's 2% target until the back end of 2011. But just look at the width of the fan in mid-2011. That's a prediction of inflation at somewhere between 5% and almost zero.

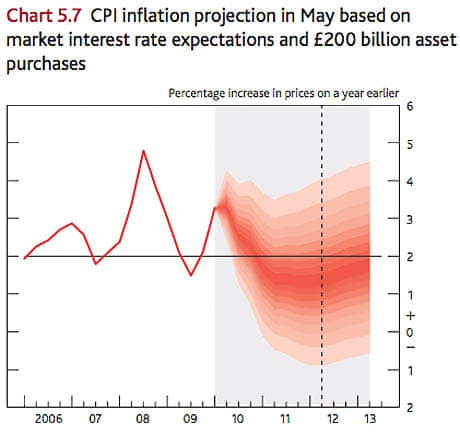

1.10pm: Last chart, I promise. This is the Bank's fan forecast for inflation from the May inflation report. The big difference between the two charts is the prediction of inflation for next year.

In May, the bank seemed certain (well as certain as economists ever are) that inflation would drop sharply in 2010 and level out in 2011. Today's chart (1.03pm) however, shows a real risk to the upside in the bank's inflation target.

(Incidentally, the further out the prediction in the chart, the less you can rely upon it for specific numbers; you can only really use it to show the general trend, and the trend in both charts beyond 2012 is for rising inflation. The assumption is, however, that by 2012 interest rates will be rising again in order to bring inflation back under control).

1.20pm: We're still getting decent reaction to this morning's news.

First a view from the boardroom, via Graeme Leach, chief economist at the Institute of Directors.

Although we agree with the Bank's general approach to monetary policy, we still take a more cautious view on GDP growth than the Bank despite its forecast downgrade today. We are also more optimistic than the Bank on inflation and expect that it will slip back over the course of 2011 with the shakeout in the labour market putting more downward pressure on wage growth.

Put more plainly, the IoD is confident that high unemployment will prevent wages rising significantly, so we'll have less to spend in the shops.

Gerwyn Davies, public policy adviser at the Chartered Institute of Personnel and Development (CIPD), has warned that the unemployment data might soon turn rather ugly, as the public sector cutbacks take effect:

Cracks now seem to be emerging; with a considerable growth in part-time work, lower pay settlements and a slower decline in the claimant count all features of a more uncertain jobs market.A larger crack will emerge when the real impact of the cuts on the public sector take effect in the autumn, with a question mark now hanging over the capacity of the private sector to fill it. The prospect of the public sector cutbacks is now being accompanied by more uncertainty in some parts of the private sector, as wariness sets in thanks to the wider impact of both the cuts and the VAT increase.

1.32pm: And here come the US trade figures.... and they're worse than expected.

America's trade deficit with the rest of the world widened in June to $49.9bn, up from $41.98bn in May. Analysts had expected the trade gap to come in at around $42bn.

1.34pm: At $49.9bn, that's America's worst monthly trade gap since October 2008. It appears that the good old US consumer is continuing to spend despite the recession, but a lot of that money is going on goods for overseas.

There was a small drop in US exports during the month, down from $152.4bn to $150.45bn - perhaps caused by falling demand in key markets such as Europe. But imports rose significantly, from $194.4bn in May to $200.35bn in June.

1.40pm: Below the top-line numbers, we can see the US trade gap with China. It has ballooned over the last year, hitting $26.2bn compared with $22.28bn in May - and just $18.4bn a year ago.

As with the overall deficit, this is the worst number since October 2008 - a particularly dire time for global trade following the collapse of Lehman Brothers.

1.58pm: Here's Rob Carnell from ING Bank on the US trade data. He bluntly dubs it "more bad news" for the American economy, which can't simply be blamed on one-off effects like changes to the oil price (which can distort the picture):

The damage came from both imports and exports. Exports fell 1.3% month-on-month, a broad based decline, whilst imports continued to come in strongly (+3.0%MoM). Given some of the weak wholesale sales data and evidence of involuntarily rising inventories in some sectors, we would be surprised if imports do not drop sharply in the next few months. But for now, they are still rising, and dragging on the contribution of net trade to growth. The current 2.4% GDP estimate for 2Q10 may well have to be revised 0.4 percentage points lower following these trade figures – perhaps a little less given the inventory figures.

It's worth remembering that last night the Federal Reserve lowered its forecast for the US economic recovery, and launched a programme dubbed QE-Lite.

This helped to push the dollar down to a 15-year low against the Japanese yen earlier today. The patient does not appear to be in robust health.

2.15pm: Just to underline the relevance of the US trade data, the $7.9bn increase in the trade gap is the biggest monthly increase since the Commerce Department started collecting the data in 1992.

Another interesting aspect is that America's imports of consumer goods hit an all-time record of $43.1bn during June. Some of those products may have gone into inventories rather than straight into people's homes, but it still doesn't feel like a country hunkering down for a period of austerity (which is good news, at least in the short-term, if you're another country hoping for an export-led recovery of your own).

Aaron Smith, a senior economist at Moody's Economy.com, says the data indicates that the next few months will be rocky:

It's consistent with slower global growth. We're going to get less of a boost from exports in the second half versus the first half.

2.33pm: The Wall Street opening bell has just been rung....and share prices start to fall as the noise levels on the trading floor picks up.

The Dow Jones is down 1.9% at 10,422, but that's likely to be volatile for the next few minutes as the various stocks are traded, and the Nasdaq is down 2.2%.

2.39pm: There's definitely a gloomy mood on Wall Street today. On top of the Fed last night, and the poor trade data at 1.30pm, traders are concerned about economic data from China which showed that its manufacturing sector is slowing down. Many countries would be overjoyed to achieve year-on-year industrial growth of 13.4%, but for China that's a sign that activity is actually slowing down.

2.54pm: At times of crisis, you can usually rely on investors flooding into gold. And indeed, the gold price is back up around $1,205 per ounce - and Goldcore, the Dublin-based broker, argues that it will be here or higher for a while:

Risk aversion is back on after the Federal Reserve expressed concerns about the recovery. The pessimistic tone of their communication has led to increased concerns of a double dip recession. In this environment, investors should remain defensive and continue to diversify into gold.

3.00pm: With Wall Street trading well underway, we can declare with some certainty that the "markets" are far from impressed with the latest economic data. In New York, the Dow Jones Industrial Average has fallen 1.9% to 10,441 with the S&P down 2% and the Nasdaq off by 2.3%.

In London, the FTSE 100 has now fallen by over 100 points - down 107 (or 2.0%) at 5268.

That's all the economic data for the day, thankfully! We'll be back if there are any dramatic developments, but otherwise we're done. Thanks for reading.

Comments (…)

Sign in or create your Guardian account to join the discussion