Although investing is a long-term game, it is sometimes necessary to make fast decisions in order to cap your losses and protect your capital. Recent events suggest that investors in the Chinese stock market should probably have sold at the first sign that the market was starting to turn against them. Exiting since then has become increasingly costly and difficult.

I suspect that over the next year, investors in Talktalk Telecom may start to feel the same. The firm’s share price has fallen by 20% since a strangely uninformative trading statement on 22 July, which warned that results would be even more H2-weighted than usual.

Investors might be tempted to hold onto their shares on the basis that the market has over-reacted to this update, which was seen by many as a thinly-veiled profit warning. In this week’s column, I’ll explain why I think this could prove to be a costly mistake.

Cheap but not cheerful

Talktalk operates at the cheap end of the very competitive UK broadband market. It offers broadband, phone, mobile and television services, all of which it buys wholesale from others suppliers, such as Sky and BT.

As a reseller, Talktalk has to compete against the very firms from which it buys wholesale services. A high level of competition in the home broadband and quad play markets is adding to the pressure. Talktalk also lacks the exclusive sport on offer at BT and Sky.

As I write, Talktalk is offering new customers its top-end television package, unlimited broadband and landline telephone calls and a free mobile SIM, for £10 per month plus line rental. This deal is an 18-month contract and also includes a £50 retail voucher.

In contrast, BT’s headline TV and broadband offer is for £25 per month over 12 months. Although this does include BT’s costly exclusive sport, I think it’s worth questioning how much profit Talktalk will make from today’s new customers over the next eighteen months.

Rank decline

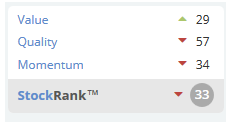

Talktalk’s StockRank fell from 51 to 33 over the last month, an 18-point decline. Only eight UK companies delivered bigger declines over the same period.

As you can see from the graphic on the right, Stockopedia’s algorithms now have a fairly dim view of Talktalk.

As you can see from the graphic on the right, Stockopedia’s algorithms now have a fairly dim view of Talktalk.