Stocks of two major gun-makers surged on Thursday morning, the day after a shooting in San Bernardino, California, left 14 people dead.

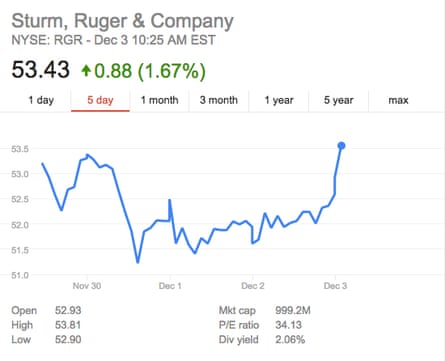

More than an hour after the stock markets opened, Smith & Wesson stocks were up by 2.62%. Stocks of Sturm, Ruger & Co were up 1.67%.

Gunmakers saw their stock rise even as the overall stock market fell on concerns that the Federal Reserve would raise interests later this month.

Smith & Wesson and Sturm, Ruger & Co saw their stocks surge in October as well after a shooting at Umpqua community college in Oregon left 10 people dead, including the gunman. Investors are betting that the shootings will lead to more gun sales: a CNN Money analysis found that over the past five years these stocks have had four times the returns of the S&P 500 stock market.

On Tuesday, the FBI revealed that last week on Black Friday the National Instant Criminal Background Check System performed a record number of gun background check. About 185,345 background checks were processed, a 5% increase from last year – and equivalent to about two a second.

As gun stocks surged Thursday morning, Federal Reserve chair Janet Yellen testified in front of the US Congress joint economic committee. When asked if mass shootings and potential terrorist attacks like those in Paris could leave consumers cautious and unlikely to go out and spend money, Yellen said that “those risks are ones that we watch vey carefully”.

She also conceded that such risks “have the potential to have a significant economic effect”, but the Federal Reserve has not observed such an effect at this point.

Comments (…)

Sign in or create your Guardian account to join the discussion